Business Loan Apply Online: Streamlining Your Path to Finance

```html

Estimated Reading Time

Approximate Reading Time: 8 min

Key Takeaways

- Online business loan applications emphasize ease and speed.

- Access to various funding sources with relaxed qualifying standards.

- Comparative testing and judicious platform selection are crucial.

Table of Contents

- Understanding Online Business Loan Applications

- Steps to Apply Online for a Business Loan

- Types of Business Loans Available Online

- Instant and Quick Business Loan Applications

- Comparing Business Loan Terms Online

- Choosing the Right Online Loan Application Platform

- Tips for a Successful Online Business Loan Application

- FAQ

Understanding Online Business Loan Applications

The online business loan application is a departure from traditional lending. It is simply an online method provided by a bank to apply online from the comfort of your home. Some of the advantages are the time-saving processes and digital view of the papers.

Comparison to Traditional Applications

- No Branch Visits: There is no need to stand in line at a bank, unlike traditional approaches.

- Less paperwork: Electronic uploads instead of bulky paper trails.

- More Widespread Access and Lower Requisites: Enjoy the ability to apply to a network of lenders without meeting strict criteria.

For additional reading, check out: NerdWallet, LendingTree, US Chamber of Commerce.

Steps to Apply Online for a Business Loan

- Decide on Appropriate Business Loan Types: Select the type of loan you want.

- Check Eligibility: Consider lender criteria like business operation duration, credit score, and annual revenue. Typically, lenders look for at least six months of operations and a reasonable credit history. More information at US Chamber of Commerce.

- Collect Documents: IDs, financial statements, business plans, etc.

- Fill Out an Online Application: Provide documentation online.

- Wait for a Decision: Some platforms offer instant responses; others within one business day.

Further reading: LendingTree, US Chamber of Commerce.

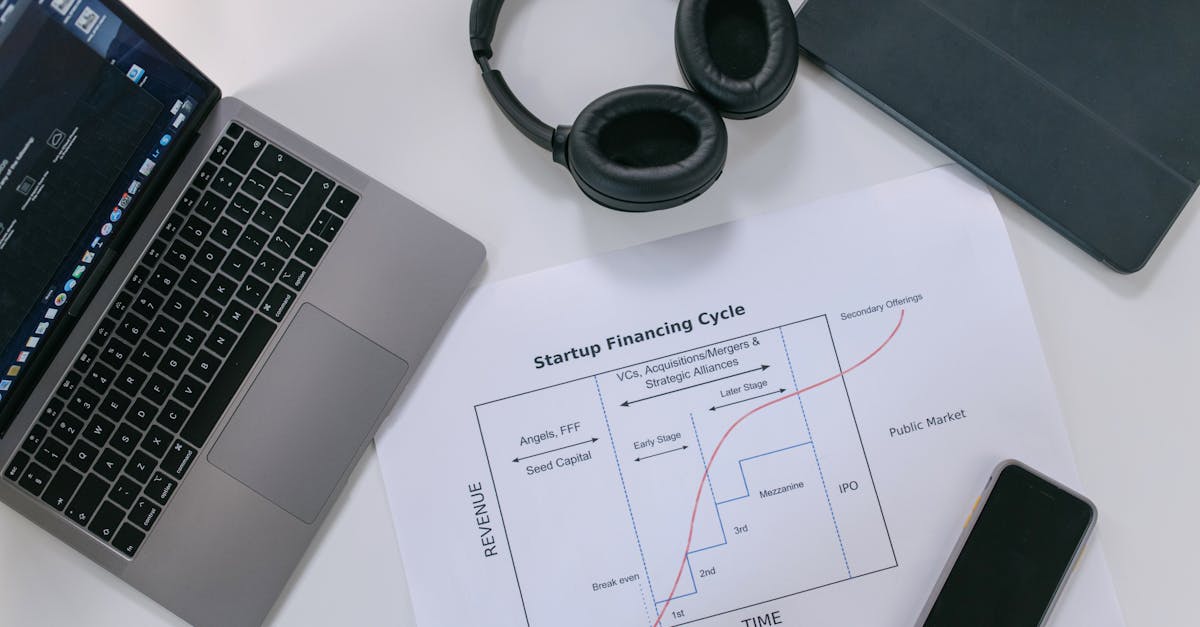

Types of Business Loans Available Online

- Small Business Loans: Traditional loans with fixed payments.

- Startup Business Loans: May require highest credit score or collateral.

- SBA Loans: Provided by the U.S. Small Business Administration for long-term, low-interest rates.

- Lines of Credit & Merchant Cash Advances: Satisfying demanding capital requirements.

For a more robust set of examples, visit: US Chamber of Commerce, SBA.

Instant and Quick Business Loan Applications

Lenders offering online applications cater to applicants seeking quick capital. Features can include pre-qualification in minutes and funding in days. Perfect for a fast injection of capital. Find out more at NerdWallet.

Comparing Business Loan Terms Online

- Interest Rates: Fixed vs. variable rates.

- Terms of Repayment: Terms and flexibility.

- Fees: Watch for hidden fees like origination or prepayment.

- Money in the Bank: Loan disbursement speed.

- Lender Reputation: Company history and client reviews.

Resolve comparison challenges with online tools and lender sites: NerdWallet, LendingTree.

Choosing the Right Online Loan Application Platform

A reliable business loan site should have secure data protection, honest terms with no hidden fees, and strong customer support. Check platform legitimacy with US Chamber of Commerce.

Tips for a Successful Online Business Loan Application

- Checking for Accuracy: Ensure completeness and correctness of all forms.

- Keep Your Credit Strong: Higher scores offer more loan options.

- Create a Great Business Plan: A well-crafted strategy strengthens your application.

- Credit Score Impact Management: Fewer applications improve scores.

- Responsive Communication: Respond promptly to supplement requests.

Explore additional tips at NerdWallet.

Final Thoughts: Applying for a business loan online offers unparalleled convenience, access, and flexibility. Begin your journey and unlock business potential.

FAQ

What is the biggest benefit of an online business loan application?

Online applications are fast and easy, and you don't need to visit a physical office.

What is the speed of an online business loan disbursement for me to get funds?

Funding is often available in days, depending on lender operations and your preparedness.

Am I able to compare several business loan offers online?

Yes, comparison tools allow evaluating offers based on terms, rates, and more.

Apply for funding with WeFrontIt here.

```