Business Loan Today: Fast-Track Your Way to Urgent Business Funding

```html

Estimated Reading Time

8 minutes

Key Takeaways

- Quick business loans provide immediate financial assistance.

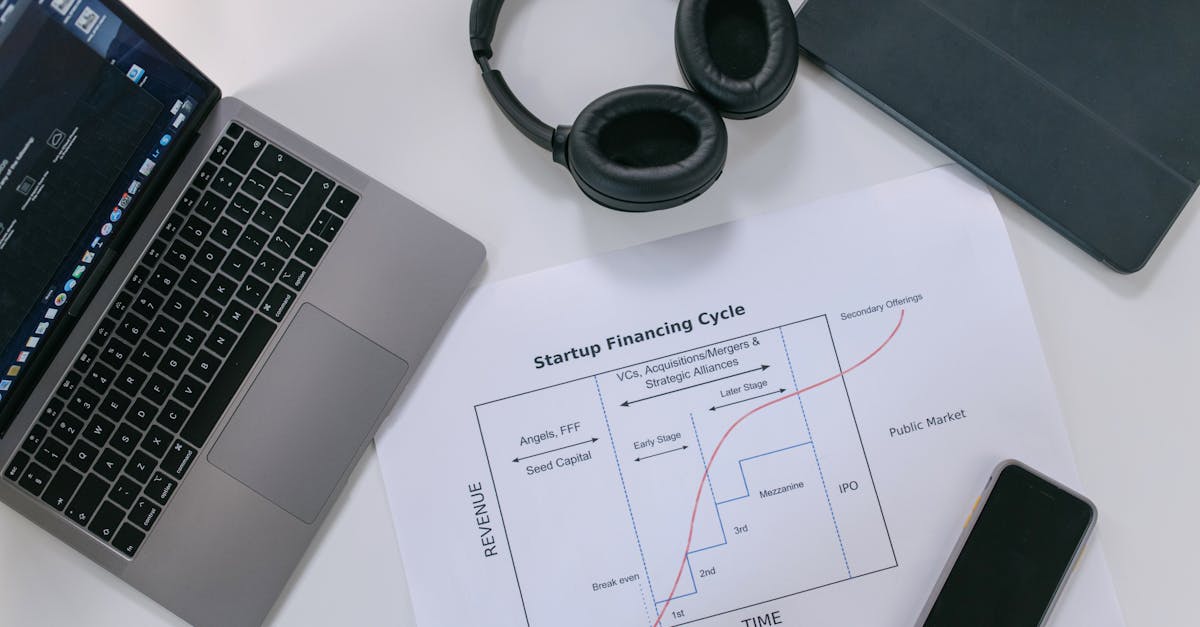

- Understand different types of loans to choose the right one for your business.

- Online lenders facilitate rapid loan approval processes.

- Effective utilization of funds is crucial for business growth and stability.

Table of Contents

- Why Short-Term Business Loans Are Incredibly Useful

- Compare Your Options Before You Choose a Business Lender

- Experience Unprecedented Convenience When You Get a Business Loan from WeFrontIt

- How to Apply for a Business Loan Today

- FAQ

Why Short-Term Business Loans Are Incredibly Useful

Quick business loans are necessary to cover financial gaps whether it's for payroll, unexpected repairs, or supply chain disruptions. Such loans ensure business continuity during emergencies.

Compare Your Options Before You Choose a Business Lender

Before selecting a lender, it is essential to compare the options available, rates, fees, and lender credibility. Look for transparent lenders to avoid hidden costs and ensure you get the best possible deal.

Experience Unprecedented Convenience When You Get a Business Loan from WeFrontIt

Apply for a loan with WeFrontIt for flexible funding options that can be secured in as little as 24 to 48 hours, thanks to our quick application process with minimal restrictions.

How to Apply for a Business Loan Today

Research fast-approval lenders, gather necessary documents like proof of ownership and bank statements, and apply online for quicker access to funds. Compare rates from different lenders, focusing on transparency.

FAQ

- What are some of the advantages of using a fast business loan?

- What is the fastest way to get a business loan approved?

- What do you need for a fast business loan?

- How do online lenders speed the loan process along?

```