Small Start-Up Business Loans: A Comprehensive Guide

```html

Estimated Reading Time

10 minutes

Key Takeaways

- Knowing the best financing option to choose requires determining your specific funding needs.

- There are all sorts of loans, traditional, government, alternate, equity.

- Compare all your loan options on interest rates, repayment terms, and reputation of the lender.

- If you have poor credit, look at microloans or secured loans.

- Get a great business plan, the things needed for the application and documentation.

Table of Contents

- Understanding Small Business Funding Needs

- Types of Funding Options for Startups

- Evaluating Loan Options

- Special Financing Options

- Application Process

- Conclusion

- FAQ

Body Content

Understanding Small Business Funding Needs

Small business funding needs vary depending on industry, business type, and growth goals. One key to finding the right financial support is to understand your exact funding requirements.

- Equipment and inventory: Necessary for most businesses.

- Operating costs: Renting space and using utilities.

- Marketing and advertising: In order to generate brand awareness.

- Bulleting board: Hiring and training staff: To keep things running efficiently.

- Technology infrastructure: To stay ahead of market demands.

Knowing these distinctions will assist you in securing the right financing for your small business startup.

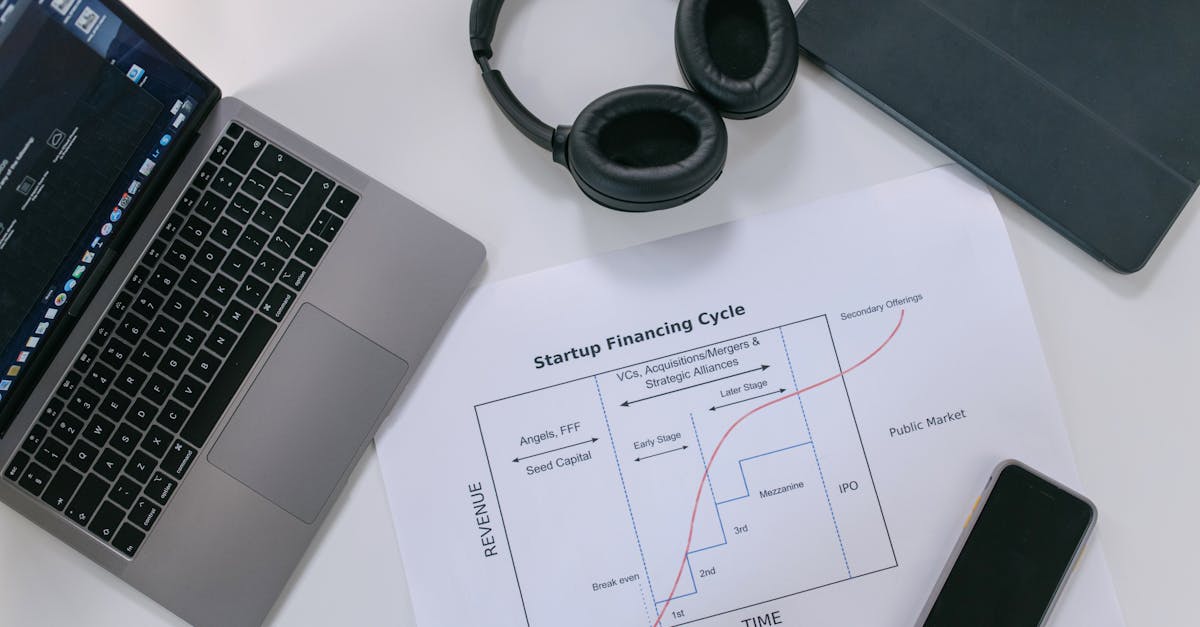

Types of Funding Options for Startups

Loans for Small Business Startups: For small business startups, traditional loans are always a great option for any entrepreneur out there. Car loans from banks, credit unions, and other financial institutions are designed with repayment schedules.

Eligibility Criteria: Generally needs good personal credit (690+) and a solid business plan, with lots of revenue to boot. Some lenders also want you to be in business for at least two years.

D/T Forms of Loans: Small business start up loans, unsecured small business loans startups, SBA small business startup loans, online business loans for startups.

Government Loan and Grant: The government provides lots of lending programs to help small businesses, especially the Small Business Administration. SBA Loans: 7(a) Loan Program: Provides up to $5 million for different applications. Microloans: For small startups, up to $50,000. CDC/504 Loans — For buying general capital fixed assets. Small Business Startup Grants: Offered to qualified small business owners.

Evaluating Loan Options

Important Factors to Consider in Comparing Loans:

- Interest Rates: Lower interest rates lower the overall cost of borrowing.

- Conditions of Repayment: At least the terms and conditions should be flexible and easy to handle.

- Collateral and Personal Guarantees: Do you need to provide them?

- How to apply: Seek out an easy application and realistic timeline.

- Lender Reputation: Only trust the good support lenders.

Special Financing Options

If you are a small startup, and you need a smaller amount of money, microloans are a great option.

- Microloans: If you have small financing needs that larger loans typically don’t cover.

- Equipment Financing: Direct financing towards the acquisition of essential equipment.

- Secured Loans: Need something to pledge as collateral.

- Nonbank Lenders: Less strict about credit.

Application Process

Stages of the Application Procedure and Documentation to Prepare:

- Obtain the Required Documents: Such as business and personal tax returns, licenses and financial statements.

- Business Plan: Clearly outline plan to demonstrate your vision and business plan.

- Collateralize: If applicable.

Conclusion

So there you have it… obtaining small start up business loans can be a game changer… in your start up business. Evaluate your requirements and select loans that will serve your business objectives the best. Learn how to evaluate small business finance options and you’ll build the kind of foundation you need for long-term success.

FAQ

- What is the best loan for a new business? The best loan for you will depend on your business needs, your credit score and the type of financing that makes the most sense for your situation. Old school bank loans might want a good credit score, and SBA loans present options with the government guaranty, which are most likely easier for new businesses.

- How can I finance my startup with no or bad credit? You might examine secured loans that use collateral or search for alternative lenders that have more relaxed credit demands. Peer-to-peer lending and microloans are other options for people with less than stellar credit.

- What is required to apply for a business loan? Normally, a lender will ask for your business and personal tax returns, business license, and financial statements, as well as a business plan that outlines your business’s potential and financial projections.

```