Startup Business Loans with No Revenue: How to Secure Funding for Your New Venture

Estimated Reading Time

6 minutes

Key Takeaways

- It is the opinion of many aspiring entrepreneurs that you cannot get a loan if you don’t have any revenue.

- Even for a startup, there are accessible options like microloans and equipment financing.

- A strong application and planning can increase your odds of being accepted.

- It's important that you know the various lenders and their criteria.

Table of Contents

- Startup Business Loans with No Revenue

- Microloans

- SBA Microloans

- Equipment Financing

- How to Get Startup Loans With No Revenue

- Investment-Friendly Lenders to Consider

- Final Thoughts

- FAQ

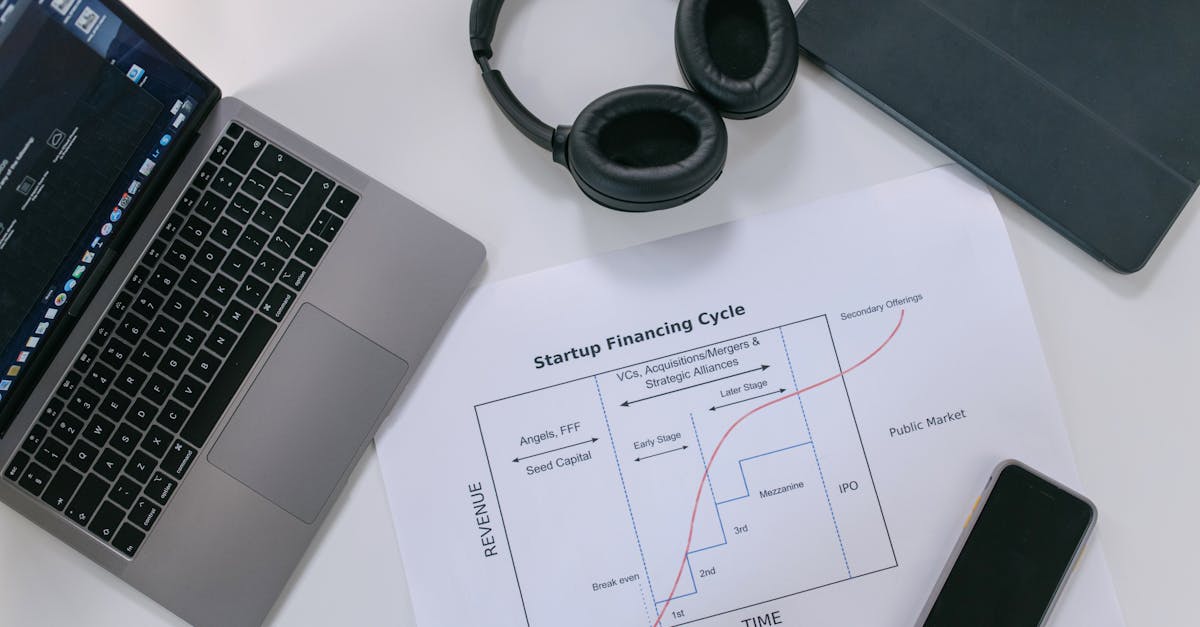

Startup Business Loans with No Revenue

How can I get startup financing? One of the key challenges for many aspiring entrepreneurs is raising funds with no revenue in sight. The concept of getting a startup business loan without any revenue can be overwhelming, and may even seem implausible. However, there are paths you can take, contrary to common perception. These avenues allow small businesses to be successful without initial cash flow.

Microloans

Great for startups, microloans are loans specifically created for businesses that are not generating revenue yet. Typically, such loans are funded by:

- Nonprofit organizations

- Mission-based lenders

- Community Development Financial Institutions (CDFIs)

They're highly adaptable, made for new companies with a far easier qualification process.

SBA Microloans

A similarly promising path is through the Small Business Administration’s (SBA) microloan program, which can provide up to $50,000 to new entrepreneurs.

Equipment Financing

This option allows startups without revenue to purchase good machinery, with the machinery itself being used as security. Lenders focus on the value of the equipment, as well as your personal and business credit scores.

How to Get Startup Loans With No Revenue

Approach obtaining a startup loan with great precision. Here’s what to consider:

- Calculate How Much Money You Need

- Determine Your Timeline

- Get Your Paperwork In Order

- Put Together a Thorough Business Plan

- Shop Around for Better Terms

Investment-Friendly Lenders to Consider

Consider lenders such as TD Bank, community banks, and credit unions, which often have special programs for startups.

Final Thoughts

Getting a loan for startup companies without revenue is possible but challenging. A robust business plan and establishing a solid business credit foundation are essential for future success.